Rethinking risk management models to face with unstable geopolitical scenarios

Are we facing a risk of a blockade of maritime trade and a possible oil shock?

The question that has been echoing for some time now we have heard it often in recent years. We experienced it in the pandemic era with the worldwide repercussions of the health crisis, we re-experienced it last year with the continuation of the Russian-Ukrainian conflict with the blockage in gas references from Russia to Europe, and we are touching on it again in this 2024 with the domino effect triggered by the war in Palestine.

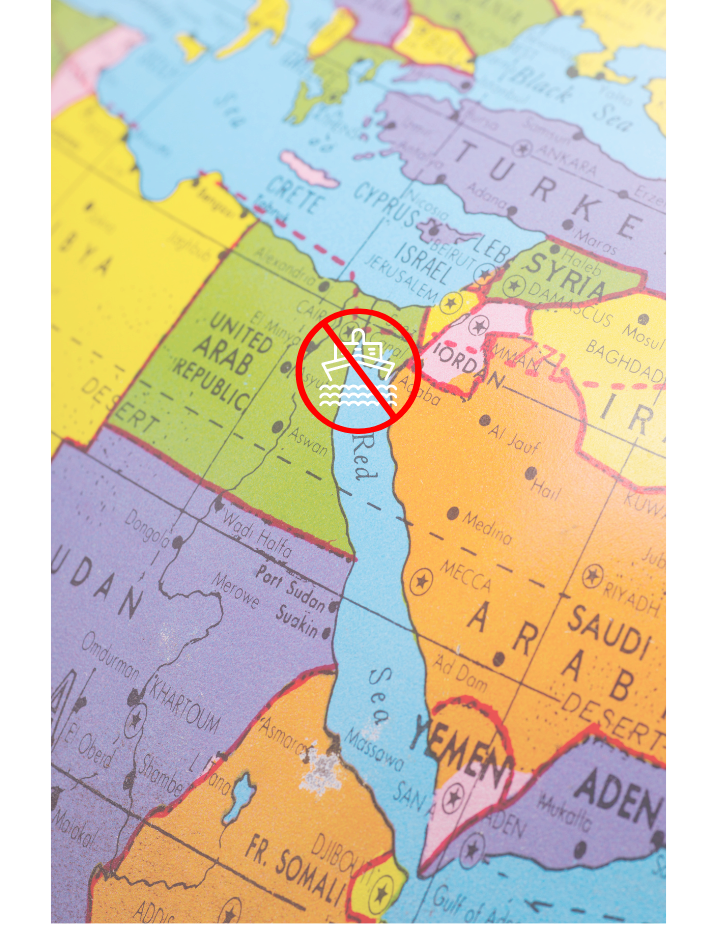

Maritime traffic in the Red Sea

There is certainly an undeniable link between the tense climate that the conflict in the Middle East is having on trade from the Red Sea and the logistical complexities and negative impacts it has already had on supplies around the world. The impact on our Pease would deserve an ad hoc analysis, also bearing in mind that about 40% of Italy's seaborne import-export trade transits from Suez. The huge effects on international trade and a new inevitable increase in costs, as a negative effect due to the changes in the routes of the merchant ships of the main shipping companies, are however already tangible and are blocking some production and industrial sectors.

Reflection on the importance of learning from past experiences arises spontaneously, given that many of the crises of recent years have involved logistics management and supply chains, often exacerbating existing critical issues that have never been fully resolved.

Rethinking risk management models

The issue reopens the debate on the importance and necessity for companies to rethink their risk management models and adopt operational and business continuity policies that cannot disregard the assessment of the impacts - not only economic and financial - of geopolitical scenarios. In the adoption of an approach capable of interpreting risk management according to a transversal and cross-sectoral process, the roots can certainly be laid for the emergence of an organisation's ability to be resilient as a strategic element and a concrete response to widespread economic instability.

In a highly competitive and dynamic scenario, where there is a loss of confidence in the market and in the supranational crisis management capabilities of even large organisations and stakeholders, the ability to adapt to rapid changes in the political and socio-economic framework and to respond proactively to its effects on a global level, is central to business continuity strategies.

Francesca Balducci, Criminologist and Security Manager Think Tank Secursat